Russell Reading, Head of Decarbonisation and Energy Markets for Zeigo Power speaks on the state of Renewables in the UK market.

Many people agree that increasing renewable electricity generation on the UK Grid system is beneficial, despite concerns regarding energy costs, network issues, and managing intermittent technologies. However, these concerns must be addressed to achieve decarbonization goals.

AtkinsRéalis, an engineering company, has published research forecasting negative consequences if the UK’s annual energy build rate does not increase. They estimate that 15.5GW per year needs to be built to reach net zero power by 2050, but only 4.5GW was connected to the national electricity grid in 20221.

I truly believe that PPAs are an excellent way to drive increased renewables on the grid – so how can they be incentivized to increase deployment closer to the level that AtkinsRéalis believes we need?

Targets

The UK has set the most ambitious target to reduce UK carbon emissions by 68% by 2030 compared to 1990 levels – and is the only major economy to have set a target of 77% for 2035.2 This includes 50GW of offshore wind by 2030 and 70GW of new solar PV by 2035. The Government stated in 2021 that it intends to shift all electricity generation to clean sources by 2035 and in the 2022 energy security strategy it reiterated this plan.

In 2023 we had new wind records including on 20 April the UK achieved the highest ever solar generation record at 10.971GW3 and on 18 September the UK grid achieved the lowest ever carbon intensity of 27 gCO2/kWh4.

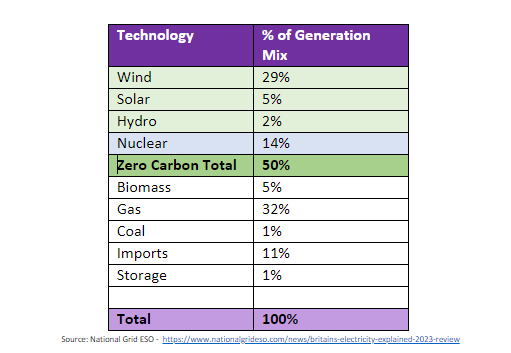

Zero carbon sources outperformed traditional fossil fuel generation in 2023 by providing 50% of the electricity used this year, compared to 32% from gas and 1% from coal stations. 10% of the energy consumed came as imports with Biomass providing 5%.

Decarbonizing the power generated by the remaining gas-fired generation is the next key step towards the 2035 target but despite the government announcing the biggest nuclear expansion in 70 years5(which has the potential to deliver 4 times the current capacity in 2050 ) we still seem to be a long way from hitting the target in 11 years.

Features of an Ideal Solution

Cheap, plentiful renewable power? Well yes, that’s the ideal, but what are the features of the future market for energy that the UK needs today – especially where a 100% decarbonized grid is considered?

Supply vs Demand

Any solution needs to stimulate both supply and demand. Right now, the UK demand for renewable power is higher than ever. More and more companies are looking to source renewables (as it’s what we, the public, demand) whilst trying to balance the current high costs of energy. The cessation of imports of EU Guarantees of Origin, combined with the extra demand for renewables (and lower than expected production in some technologies) has combined to send the prices of UK REGOs skyrocketing. These factors mean that demand for PPAs is higher than ever right now as they can make commercial sense both in terms of price and in terms of future security and risk management.

Power Purchase Agreements (PPAs) are expected to form a key part of the future energy decarbonization solution and be part of the Review of Electricity Market Arrangements (REMA) so that government involvement (and subsidy) can be reduced.

Sadly, PPA supply seems unable to keep up with this demand and there are several influencing factors. Delays in getting grid connections are stymying projects at an early stage, meaning that corporates looking for renewable projects are being quoted commercial operation dates as far ahead as 2031. This doesn’t help their decarbonization strategies!

Another blocker is the apparent need for PPAs to be of a certain size and for corporates to have an investment-grade credit rating. This is to maximize the value and return of the renewable project whilst de-risking the investment – but as the larger consuming companies progress their decarbonization strategies and complete CPPAs, the mid-market is getting left out in the cold because they are not “blue chip” and don’t have huge energy demands. Getting over these hurdles could open the next wave of developments (assuming they could get connected to the grid) and begin to again reduce the reliance on gas – with no cost to the public purse. This could potentially start a new diversification of revenue stream for developers, asset owners, and generators.

Key Features

To see more renewables built, the time to connect to the system needs to be reduced so projects can get moving. Efficiencies in the permitting process need to be addressed by the government and/or Ofgem. The most recent legislation change was welcomed, but investors also need to be able to manage the risk of their investments and get confidence in the returns on investment in new renewables.

From a consumer point of view, renewable energy needs to be fairly priced and easier to access. One should also argue that any scheme to increase the amount of renewable energy needs to be egalitarian and fair so that everyone can participate if they choose to. Failure to address this means that segments of business or society would be left out – potentially bearing higher costs of energy that they can do nothing about.

So, How Do We Make This All Happen?

Gov Subsidy/Scheme eg CfD

As it has done with the CfD scheme, the Government could provide some subsidy or scheme to address the investment risk issues of building new renewables. However, at the end of the day, someone must pay for this – and it’s us, the energy users. It could certainly be a direct path to getting new zero-carbon generation on the network, but no one wants the costs of such schemes to spiral out of control – especially in times when energy prices are already high.

Theory gives that the CfD should stabilize the ultimate price consumers pay, and in a future where 100% of generation was on a CfD in the UK then the market price should tend to be more stable and at a level around the CfD price – but getting there (if that is even possible with only CfDs) could be a potentially rocky road depending on how long term and short term prices interact with each other.

Some developers favor the CfD and in their white paper Ørsted suggests6 a reform of the CfD instrument, extending it and including ways the CfD mechanism can encourage generators to deliver flexibly to support the key need for flexibility whilst maintaining investor confidence that is key in this area. Adding flexibility provisions is great but I would maintain that cost control is key and although the government is not paying for CfDs – consumers still are. I would also add that diversification of how renewables are incentivized is no bad thing. That said CfD will allow large projects to be built that PPAs would struggle to support.

PPA (CPPA / UPPA)

I am of course going to argue that PPAs are a good solution, after all, I am passionate about them and believe in what they can be used to do. They offer the potential for mutual benefits to both the developer and the corporation without dipping a hand into the public pocket. That said, some government intervention might be needed to help “unstick” the area of PPAs so that the supply of new projects can catch up with demand.

My opinion would be that over the medium to longer-term PPAs would become much more common and this would deliver benefits of reduced energy costs, reduced need for publicly funded subsidies, simplification of the delivery of all aspects of PPAs, and, of course, more renewable energy.

Avoidance of Taxation or Costs

So how about an incentive for those who take the risk and support newly built renewables without recourse to the public purse? Maybe avoiding costs like CfD socialization, or not being subject to some new carbon tax?

Might there also be advantages provided for those who choose to invest in and build renewables? The EGL exemption announced for new renewable projects is a welcome boost in this area but could something more help stimulate development?

It creates value in undertaking a PPA for the corporation, but it doesn’t alleviate the investment risk issues for the lenders financing such projects (or the grid issues for those building them).

It also risks a form of “renewable poverty” for those who cannot access PPAs would be at a disadvantage – and remember it might not be because they don’t want to, they may be unable to due to size, credit, or inability to commit for long term. Inability to access PPAs would mean facing higher costs, particularly if that is also an increased share of socialized CfD costs.

In my view, although tax exemptions can create incentives, they can also distort the marketplace and might impact the taxation collected. In the past changes have been made to the UK energy market to avoid such market distortions, so this doesn’t feel like a sustainable approach.

ROI, Credit, investment risk

OK, so a developer can find a large blue-chip corporation that needs 50GWh per annum of solar energy and is willing to commit to 15 years. Ideal? Well yes, pretty much but what about a corporate who has good credit but only needs 15GWh per annum, or who is not such a good credit risk?

Aggregated PPA (APPA or baskets or group PPA) could solve the size issue, with companies coming together by sector, goal, or common interest to aggregate their demand and enact a PPA. It needs a hub or facilitator, but more than that the risks need to be considered and managed. There’s merit in multi-sector APPAs as they can reduce investment risk for the developer and it’s less likely all buyers will experience a significant economic turndown at the same time.

If there was a way to underwrite some of these risks in a way that investors could be happy with, then we could see a large increase in PPAs both because smaller corporates could group up but also because smaller projects might also make sense as well. It’s even possible that a project could be split 2 or 3 ways without the corporate necessarily being formally grouped (eg meter splitting).

So what does it need? Whoops – public purse intervention! What if there was a scheme to underwrite some of the risks faced by investors in funding a renewable project that was aligned to one or more “non-investment grade” companies? Could the risks and costs be managed and mitigated by the government in such a way as to minimize the impact on public funds whilst creating investment confidence? I believe this is an approach worth investigating and taking forward. Whilst there is some residual risk to public funds, we believe this could be limited and stimulate PPA growth potential if implemented appropriately,

Similar approaches have been taken as in November 2022, the French Government announced that it has instructed Bpifrance to set up a guarantee fund called Garantie Électricité Renouvelable (the “GER”) to encourage the conclusion of Corporate Power Purchase Agreements (“CPPA”) with industrial consumers. It is inspired by the Norwegian guarantee for PPAs created in 20117.

It is a stark note that since the Paris Agreement, the government has provided £13.6 billion in subsidies to the UK oil and gas industry8. Could a fraction of this, in “guarantees” facilitate a major growth in PPAs?

Price Stability

Cornwall Insight has cut its 2024 power market price forecast for Britain by 12% to an average of £113/MWh9. Although prices have fallen, experts agree that it is unlikely prices will return to pre-war levels this decade with forward curves still averaging at 80.49GBP/MWh, well above historic averages which were closer to £50/MWh. This change is being driven partly by decarbonisation where renewable assets are displacing higher marginal cost gas generation.

At this level (and considering REGOs) it could still be argued that today PPAs still make financial sense. That’s alongside mitigating the risks around supplies of renewables and price volatility.

But would long-term price stability help get more PPAs off the drawing board and onto the network? It’s hard to see how that alone would give the investment confidence needed without further measures like floor prices, a fixed price, a contract for difference, or other similar guarantees (as have been used by utilities in the past).

One potential major blocker for this could be price variations caused by managing increasing volatility on the energy system as more intermittent technology is added. The question is if the UK Battery Strategy, which shows the UK’s commitment to further investment in BESS, will eventually mean more accessibility for PPAs.

Complexity

The UK energy ecosystem is not simple. It is a complex obscure rambling beast – one for which I struggle to find an analogy. That said corporates can get PPAs done, for those who commit there is a high success rate.

Corporations can be daunted by the initial requirements for advice (and costs), but there are mechanisms to support the process. We know how important it is for energy buyers to meet climate targets, our market leading combination of top-tier consulting and cutting-edge software makes Schneider Electric the partner for corporate buyers of all experience levels looking to enter a PPA.

PPA’s are either Virtual or Physical. Virtual PPAs don’t require the physical transfer of energy mitigating the risk of finding a sleeving supplier but, they bring challenges in financial risk and derivative accounting treatment complexities. Physical PPAs avoid financial and accounting risks but will need to include arrangements for getting the energy generated to the end customer.

There can be several options in the UK to get the generated renewable electricity into a corporate supply arrangement, depending on the Supplier’s attitude to PPAs, the certainty required, and the volume and nature of the PPA. (Shameless plug for our blog on “What makes a successful PPA” if you want to know more)

Attitudes across the supplier community towards PPA are also widely varying. Some suppliers are quite PPA-friendly, some moderately friendly, and some disinterested. This can lead to fears of a reduction in the options for supply arrangements – but experience has shown that the more PPA-friendly suppliers can pick up new customers by facilitating and integrating their needs.

I firmly believe that as the PPA market matures further in the UK we expect to see simplification, new entrants, and a better understanding of the processes. This would make the whole process of getting a PPA begin to harmonize and drive simplification. Some have suggested that government intervention with standard PPA terms would be a way forward but it’s hard to see how that helps, given that one party is potentially always going to have an issue with some element of such terms.

What might REMA do?

It’s unclear, but if changes are needed it will require voices to shout for them. BEIS’ requirements for the transformation of the GB energy system by 2035 are pretty much what people would expect and want10:

- High investor confidence in low-carbon technologies

- System flexibility optimized for intermittent renewables and adaptable to emerging technologies

- On-time delivery with unintended minimal disruption, despite the complexity of the existing energy system

- All delivered at the lowest possible cost to consumers

But there are many ways these could be delivered and many views as to if any proposal will deliver these. Combined with the many different roles and views of parties through the energy chain it’s not a surprise that it’s nightmarishly complex.

The end of the initial extensive consultation and the reporting of the views have moved REMA into a new phase with a second consultation proposed on key options and viable short-term changes considered quickly. But it feels to me like progress has already slowed…. and that is a shame.

Wrapping It All Together

As you would expect, I would advocate PPAs as a good way of keeping momentum towards zero carbon going, especially if it can be opened to a wider audience. Addressing this sourcing or access is at the heart of what we want to do here at Zeigo Power, but for PPAs to be a true game changer there needs to be consideration of wider market reform and system investment to give investor confidence and allow quicker connections of projects to the grid.

In summary, we need to create an environment where:

- Investors have the confidence to invest in renewable energy projects based on the risk and reward profiles

- Developers can build projects when and where they are needed to meet energy needs

- Consumers have access to renewable power without undue risk, cost, or complexity.

To deliver this the energy industry, government, and business are going to have to come together and focus clearly on how this can be done – and soon.

Footnotes

- New study warns of low UK energy build rate ramifications (current-news.co.uk) ↩︎

- https://www.gov.uk/government/news/pm-recommits-uk-to-net-zero-by-2050-and-pledges-a-fairer-path-to-achieving-target-to-ease-the-financial-burden-on-british-families#:~:text=The%20UK%20has%20set%20the,target%20of%2077%25%20for%202035. ↩︎

- https://www.nationalgrideso.com/news/britains-electricity-explained-2023-review#:~:text=In%20addition%20to%20new%20wind,and%201%25%20from%20coal%20stations. ↩︎

- https://www.nationalgrideso.com/news/britains-electricity-explained-2023-review#:~:text=In%20addition%20to%20new%20wind,and%201%25%20from%20coal%20stations ↩︎

- https://www.nationalgrideso.com/news/britains-electricity-explained-2023-review#:~:text=In%20addition%20to%20new%20wind,and%201%25%20from%20coal%20stations ↩︎

- https://orsted.com/en/insights/white-papers/getting-gb-electricity-market-design-right ↩︎

- https://www.twobirds.com/en/insights/2023/france/the-corporate-power-purchase-agreement-ppa-fund-a-driver-for-industrial-consumers ↩︎

- Climate change: UK government oil and gas subsidies hit £13.6bn since Paris Agreement, campaigners say | Climate News | Sky News ↩︎

- https://www.current-news.co.uk/cornwall-insight-forecasts-lower-gb-power-prices-on-the-long-road-to-truly-affordable-energy/ ↩︎

- https://www.whatisrema.com/meaning/rema-electricity-market-design-choices/ ↩︎