In October, Helen Dewhurst from BloombergNEF joined Meghan McIntyre of Zeigo Power in our most popular webinar to date to discuss BNEF’s latest report 1H 2023 European Corporate PPA Price Survey and delve into the trends we’re seeing in European PPA markets. Despite challenges faced by both buyers and sellers of corporate energy, one overarching theme is clear, the PPA industry is ripe for growth. In this blog we’ll review the key messages from this discussion and answer some of the most asked about questions from attendees.

Buyer Demand is High…

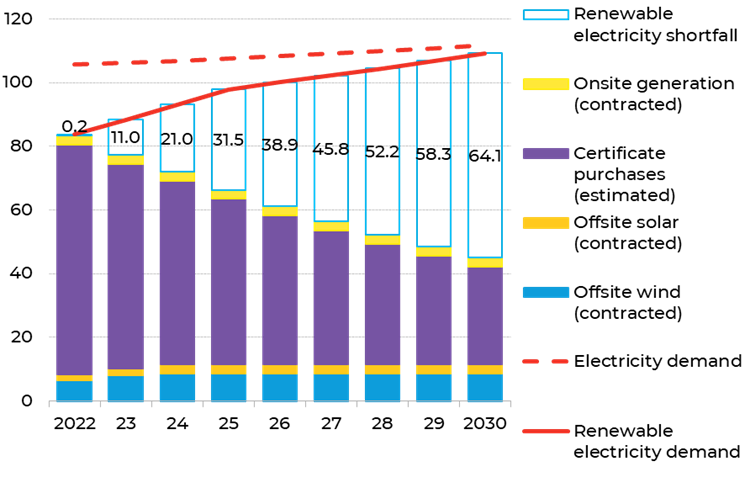

Amid increasing government targets, public pressure, and evolving framework guidelines, coupled with a turbulent year in gas and power markets, the demand for PPAs in Europe has continued to rise. It’s a somewhat contradictory conclusion as high PPA prices prevail despite a slight decline from levels seen in the second half of 2022. This climb in demand is powered by goals to meet the targets set by European RE100 members, with an additional 64.1 GWh of new renewable power required by 2030. Furthermore, there are 1,949 companies in Europe committed to the Science Based Targets initiative (SBTi), with more targets established in 2022 than in the previous seven years combined. To achieve this, PPAs provide an attractive solution as well as protection against volatile power and REGO prices.

Projected renewable shortfall for selected RE100 members, Europe

Source: Company filings. Note: *Based on an unlevered basis, except for FSFL.

… And Supply is Struggling to Keep Up

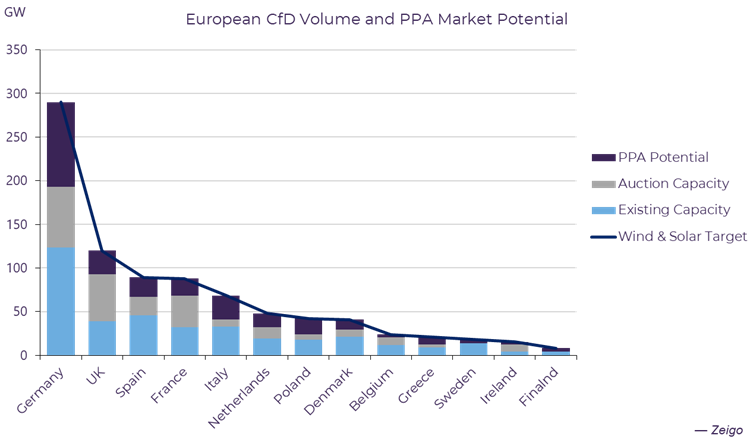

Despite high demand and buyer eagerness to engage with PPAs, supply is struggling to keep up. It is widely acknowledged that inefficiencies in interconnection approvals are delaying new projects coming online. This is exacerbated by an increasing number of requests as the drive to Net Zero accelerates. In response, efforts are being undertaken across Europe to address this and speed up this process and clean this growing backlog; nevertheless, this is not a quick fix and will still take several years to resolve. In the interim, the gap between corporations seeking to enter a PPA and the availability of suitable projects for these agreements is likely to widen.

Source: Zeigo Power.

Is Now the Time to Sign a Corporate PPA?

Considering the above market dynamics and price insights shared in the webinar, buyers have asked if now is the right time to enter a PPA whilst prices remain high, increasing by 61% year-on-year in Europe. However, as was the key take away from our conversation with Helen at BloombergNEF, the continual widening of supply and demand for PPAs in a policy environment that is becoming more stringent makes it a wise choice to act now. Looking at the market today, it is likely that buyers waiting for PPA prices to return to levels seen prior to 2022 will likely be waiting a long time.

What is the average term length for a PPA?

A Corporate PPA is generally a long-term contract, with the most prevalent tenor offered in Schneider Electric RFPs being 10 years, subject to variation depending on the market. High price volatility in recent years has led to increased demand for short-term PPAs (5 years or less in duration), particularly in the German market, with operational assets more likely to be offered for shorter durations. However, due to recent changes in RE100 guidelines and longer-term PPAs for new build assets being more economically favourable for the developer, we anticipate that the majority of Corporate PPAs will maintain typical term lengths between 10 and 15 years.

Does the term length influence the price offered by a developer?

Short term PPAs have a greater opportunity cost against the wholesale market, because of this, forward prices have a higher degree of influence in these deals. Whilst there are other factors that determine the final price, buyers can expect to pay more per MWh for shorter term lengths compared to long-term contracts where the final price is more heavily influenced by the Levelised Cost of Electricity, which is the expected average net present cost of electricity generation over an assets’ lifetime.

Where does Zeigo Power work and how do developers join Zeigo Power?

Our platform supports RFPs directly between pre-qualified, experienced, buyers and a seller as well as RFPs released with the support of a third-party consultant. We are currently active in all European markets. Zeigo Power is free for developers to join, where you will be notified of RFPs released by corporate buyers and be able to respond with an offer. Also, following feedback from our customers, Zeigo Power has revised its business model and removed success fees from all RFPs submitted directly from a corporate buyer. Please note, if an RFP includes an external consultant a Success Fee may still be included which the platform will notify you of.

How does Zeigo Power ensure prices received on the platform are fair and competitive?

• Our platform encourages fair and transparent pricing through our developer feedback feature. The feedback provided helps our developer community understand how well their offer aligned with the specification submitted by a buyer, and includes:

• Price: How competitive the price offered is compared to others, discouraging price inflation.

Volume: The amount of energy offered and its suitability for the tender.

Term: How the term offered compared with other bids and the PPA start date requested by the buyer.

Other factors: Additional aspects that may influence buyer decision.

By providing this feedback, Zeigo Power is working to encourage a competitive and transparent PPA tendering process, increasing the chance of a PPA being successfully signed.

Buy Renewable Energy Now

Corporates looking to sign PPAs can find both operational and new build projects on the Zeigo Power platform.

Get Started