Unless you’re a global multinational with established renewable energy procurement processes and dedicated resources, negotiating power purchase agreements (PPAs) can be a daunting task.

Most companies need to engage outside support to help them do the following:

- Find projects that fit their sustainability objectives and load requirements

- Understand the metrics that maximize a PPA agreement’s long-term value. The variables that impact price and mitigate risks attached to clean energy generation are very different from those found in traditional utility contracts, where power is delivered from traditional generation sources.

While it’s not an exhaustive list, we’d suggest corporate energy buyers start with these six core considerations to help them decide which renewable generation projects constitute a savvy investment — and those most likely to help them achieve their clean energy procurement objectives.

1. Volume and term

The most important considerations in any PPA negotiation are the volume of generation output purchased and the term of the contract. Every corporate buyer has different procurement objectives and every PPA is different, with terms negotiated between projects and individual offtakers, and no industry-standard template to base contracts on.

The volume of electricity purchased is often fixed, based on the requirements of the offtaker and a project’s need for a predictable revenue stream to underpin financing.

Prices can be fixed for shorter terms (ex. six years) and renegotiated later or set at a longer fixed term (ex. fifteen years).

2. Pricing Structure

Along with providing a straightforward route to renewable energy procurement, PPA’s are also used as a hedge against future price rises. Determining the PPA pricing structure, and the calculations underlying it, is a crucial step.

Contracts typically specify the rate (£/kWh) a corporate buyer will pay a developer for the project’s output. It often includes a fixed price along with an escalator — a contract clause enabling the PPA price to increase over time but at a controlled rate of growth, generally less than 3 percent.

In a virtual or synthetic PPA, the corporate buyer buys the electricity at a negotiated ‘strike’ price. The project then sells the power into the wholesale market under a contract for difference (CFD). That means if the electricity is sold into the market above the strike price, the project pays the company the difference. If the electricity is sold-in below the agreed price, the company pays the project the difference.

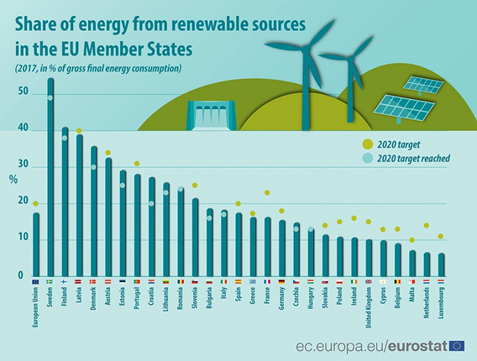

3. Country Growth Rate for Renewables

This refers to the penetration of renewables in the corporate buyer’s national market (or markets), measuring the percentage of electricity coming from wind, solar, tidal, hydro, and geothermal generation.

Understanding the renewables growth rate for the countries where settlement takes place (and referencing it in a PPA) provides important context, helping corporate energy buyers understand the volume of clean power currently on a national grid and how much is projected to be there in the future. Changes in the volume of power generated by renewables can impact energy prices and affect the value of a company’s investment in a particular project.

For example, if the projected growth rate is high, or a percentage of additional renewable capacity is expected within a specific time frame due to the scheduling of specific projects, the additional clean energy volume could put downward pressure on price. PPAs should be structured with this in mind and have growth-rate triggers written in that enable pricing to be revisited.

Source: ec.europa.eu/eurostat/

4. Development Risk

Despite their apparent promise, some generation projects never get off the ground. Knowing the level of risk attached to development is essential for determining which investments are most likely to be seen through to completion.

According to McKinsey, poor risk assessment and risk allocation early in the concept and design phase of a project can have knock-on effects that lead to higher risks later. With data and analytics, projects can be risk-scored by factoring in, and weighting uncertainties related to site control, permit applications, financing, interconnection, and regulatory compliance — any of which could derail a project’s timeline or stop construction.

The risk score calculated could well point to a high likelihood of project failure or significant delay, even where the projected long-term value is positive.

If the risk of a project dying on the vine outweighs its potential benefits, that needs to be recognized in the PPA with stipulations to ensure effective risk management and risk allocation.

5. Project Price Volatility

To address the level of price volatility attached to projects that are already operational, corporate buyers should consider its pattern of historical price fluctuations.

Tracking recent swings in a renewable project’s settlement price (the difference between profit and loss on a typical day) clarifies how it’s performed in the past, and how it’s likely to perform in the future. That enables corporates to negotiate pricing and terms based on data-driven projections of future price swings.

Source: fool.com/investing/how-to-invest-in-solar-energy-stocks.aspx/

6. Consumption profile and shape of generation

The energy usage patterns, and volume needs of individual organizations are distinct from one company to another. Each has a unique consumption profile that impacts their energy load and the shape of the renewable generation needed to match their requirements. Understanding the level of correlation between the profile of a potential corporate buyer and the shape of a project’s generation and is essential if the buyer’s energy needs are going to be met. Wind projects are a leading source of renewable power in the UK but tend to generate most of their power during the night. Large retail chains draw most of their energy during daylight hours, so relying on wind alone would be a poor fit.

Building a diversified renewable energy portfolio that combines different projects and technologies would provide a better match between a retailer’s consumption profile and the shape of generation.

The search for suitable projects

Zeigo has developed several automated tools to help energy buyers identify and analyze renewable energy projects.

If you’re a corporate energy buyer ready to embark on your journey to direct renewable procurement, getting to grips with the complexities of PPA negotiation will take time.

Your Renewable Energy Guide

In this eBook, we outline a step-by-step process for achieving your emission reduction targets through renewable energy.

DownloadThe renewable energy market and regulatory environment are both complex, with every project requiring analysis to understand risks, benefits, and potential drawbacks.

In a survey of corporate energy buyers by Baker & McKenzie, almost 70 per cent said they lacked the necessary in-house skills to negotiate renewable energy PPAs. Missing expertise stops many corporates from even exploring PPAs’ potential benefits and can also lead to failure once negotiations have begun.

Creating a PPA that maximizes cost reduction and pushes you toward renewable energy targets requires a structured approach. There’s no one-size-fits-all when buying clean power and understanding key metrics in the context of your company’s unique power consumption profile, is a great place to start.

This article originally appeared on Schneider Electric’s Perspectives blog.

See Original Post