As renewables grow in popularity, Battery PPAs and storage projects are expanding too. Here’s how corporate energy buyers can benefit.

Back in 2014, Europe held 44% of the world’s battery storage market. That’s since dropped back to 30% and might halve again by 2030 if current forecasts hold true.

What’s happening? Europe is falling behind China and the US in battery storage capacity thanks to the lack of EU government incentives for flexible power. At the same time, demand for renewable energy is growing. Demand for battery storage to help manage weather-dependent generation sources will grow with it.

How can corporate energy buyers avoid the coming squeeze?

The Potential of battery storage PPAs

Battery power purchase agreements (PPAs) can give businesses a direct route to procuring the storage capacity to complement their renewable energy purchases.

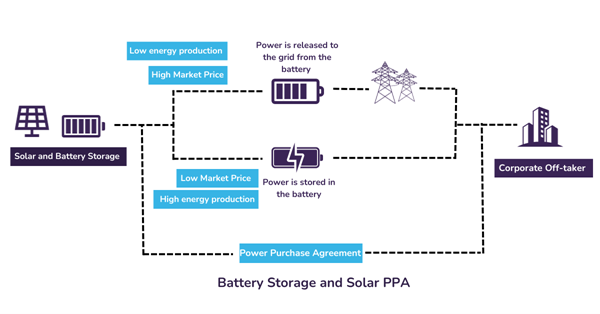

Using batteries alongside a renewable project can result in power being stored during periods when production is high, and prices are low. Excess electricity can then be sold back to the grid during times of lower production and higher prices.

There are two types of battery storage PPAs:

- A joint PPA encompassing renewable energy (usually from solar) and energy storage

- A standalone battery storage PPA

Stand-alone contracts react more to market conditions, whereas joint renewable & storage PPAs are much subject to the performance of the project’s generation.

Low power demand in 2020 driven by lockdown restrictions means we have witnessed low and negative pricing become more and more regular, highlighting the lack of system flexibility. Using batteries alongside a renewable project can result in power being stored during periods when production is high and the prices are low, the power can then be sold back to the grid during times of low production and high pricing.

What are the benefits?

If a battery storage PPA is structured correctly, there can be pricing benefits for both the developer and the offtaker. The storage operator secures a consistent revenue stream to support project finance while the buyer gains an effective hedge against battery storage price volatility.

There are added benefits with a reduced need to balance and shape during unpredictable output periods, as the storage can take over. This will make the power more environmentally friendly, with less reliance on buying fossil electricity from the grid when production is low. There is further impetus for increased storage with the imminent changes to our energy demand. With the rapid introduction of electric vehicles, the is a greater need for green power to be widely available at all times of the day.

So far, however, most storage PPA contracts being signed are for corporates with significant energy demand. For companies with small to medium power demand, there is a financing issue with joint renewable and storage PPAs as storage does not benefit from similar operation and maintenance as solar does, which makes it hard to incorporate both elements into the same PPA contract. Storage will only be covered for as long as the battery manufacturer’s warranty is valid, and so offtakers rarely agree to a contract where the O&M package does not last for the duration of the term.

Battery storage outlook

Will there be enough battery capacity to keep up with demand? When the market was still in its infancy, price was a significant barrier to investment. In the past two years, however, prices have dropped by half to approximately £150/MWh on average. In China, prices are even lower at $115/MWh.

This has spurred investment into new projects into UK projects within the past few years, notably:

- Statkraft signed a hybrid PPA with Warrington Renewables Limited in York for 35MW of solar alongside 27MW of battery storage. – 01/06/20

- Macquarie’s Green Investment Group (GIG) has formed a joint venture with Enso Energy to develop 1GW of unsubsidized solar plus storage capacity in the UK

- EDF has also announced a partnership with Octo Energy to construct 200MW of solar plus storage capacity in England and Wales

- Shell signed a PPA to buy power from a 100MW battery storage project run by two Chinese state-backed companies in southwest England. Its intention is to optimize the integration of renewable energy generation nearby

- Hitachi has pledged millions in a partnership with GRIDSERVE to help fund projects including two hybrid solar farms as well as an electric forecourt in Essex

If Europe is going to keep up with rapidly evolving storage markets in China and the US, governments will have to find new ways to support hybrid generation-storage projects. At the moment, they are a poor fit for capacity auctions — despite large-scale solar being on track to become of the cheapest energy sources in any category, renewable or traditional.

Continue Learning

Stay updated on your battery storage options and learn more about PPAs in Zeigo Network.

Join Now