Recently there has been significant volatility in European power markets which has increased both buyer hesitancy and interest in PPAs. At the same time, as 2025 and 2030 decarbonization targets loom, sustainability strategies are coming to the forefront of buyer motivations rather than being secondary to hedging potential. As the market has faced significant change, we have re-looked at the potential of short-term PPAs and whether they remain a valuable element of a corporate’s sustainability strategy in the current climate.

Market vs. PPA Prices

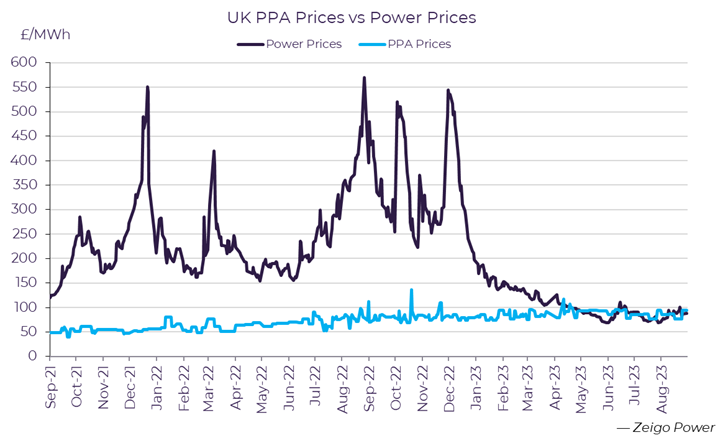

Price implications remain a critical factor in buyer decision-making during PPA negotiations, with financial benefits compared to the market playing a significant role. As illustrated in the figure below, despite a recent decline in PPA prices due to the decreasing levelized cost of electricity, average PPA prices now trend to equal the current wholesale market.

This observation is even greater for shorter-term deals, data from the Zeigo Power platform finds that short-term agreements average 38% higher per MWh than deals with a 10–15-year term. Furthermore, many shorter-term deals are linked to assets already in operation, facilitating more immediate PPA start dates and therefore commanding even higher prices due to their reduced risk profile.

Taking these factors into account, are short-term PPAs financially viable? In short, yes. While they may not guarantee cost savings against the market throughout the duration of the agreement, short-term PPAs continue to offer a hedge against volatility during a period when European markets remain in a precarious position. This understanding is crucial when approaching the tendering process for a short-term PPA and building a business case to present to internal decision-makers. But once decision-makers reach this conclusion and decide to proceed with a PPA for their hedging potential, why would they select a shorter-term deal over traditional longer deal lengths, especially given the higher costs involved?

A two-step PPA strategy

The strength of short-term PPAs lies in their ability to facilitate immediate and impactful progress for corporate buyers in achieving their decarbonization targets. As European legislative bodies contemplate reforms to address grid-connection and permitting delays faced by renewable projects seeking to come online, demand continues to outpace the supply of new build projects available for PPAs. While additionality—the concept of contributing to the renewables transition by financing new green energy assets to replace fossil fuel-based power resources—is important to buyers, prioritizing additionality at the expense of delaying decarbonization of business operations may not necessarily be more effective. Instead, a two-step PPA strategy could offer buyers both immediate decarbonization and target achievement through a short-term PPA, whilst providing the breathing space to enter a longer-term PPA with a new build project once the short-term PPA concludes.

For some energy buyers, committing to long-term contractual agreements may be financially or strategically difficult at this time, especially in the wake of a year marked by intense energy prices. In such cases, shorter-term PPA offers interim support and access to renewable energy whilst buyers build a business case and tender for a long-term PPA with a new build asset. Indeed, the unprecedented price volatility experienced last year and the rapid nature of deals associated with operational assets led to increased demand for operational PPAs on the Zeigo Power platform in 2022.

Next Steps

As the Russian-Ukraine conflict intensified commitment to renewable energy, policymakers devised strategies to reduce dependence on Russian gas for energy security and economic protection. Among these proposals is the increased use of long-term power contracts for commercial buyers, including PPAS. This, coupled with growing pressure to achieve corporate climate goals and the subsequent rise in demand for PPAs during a period of permitting delays, will make securing such agreements more challenging.

While PPAs for new build assets continue to be seen as having the most significant impact, short-term PPA terms with operational assets can serve as a valuable stopgap within a corporate sustainability strategy. This approach ensures that companies utilize clean energy at competitive rates, achieve immediate emission reductions, and maintain the flexibility to gain additionality in the not-so-distant future.

This article originally appeared on Schneider Electric’s Perspectives blog.

See Original Post